uropean shares edged ahead on Wednesday, helped by good earning updates, but bank stocks hit a five-week low on growing concerns over the region’s crowded election agenda this year.

The STOXX 600 rose 0.3 per cent after a volatile session that saw the pan- European index dip into negative territory at one point, weighed down by financial stocks which are seen as most sensitive to political uncertainty.

At the forefront of investors' concerns is the French presidential election, with worries about the strong showing of far-right candidate Marine Le Pen keeping euro and French debt under pressure on Wednesday.

"Pressure on financials is high," said Andrea Cuturi, chief investment officer at Anthilia Capital Partners in Milan. "Suddenly investors have waken up to the prospect that it will be a year of elections in Europe. Le Pen's speech on Sunday was enough to trigger a broad risk-off mood across the region."

DUBLIN The Iseq was up marginally at 6,410. Bank of Ireland had another poor session, reflecting the current weakness in European financials, closing down 1.7 per cent at 23.5 cents, having shed 3.2 per cent on Tuesday.

Ryanair also continued on a downward trend following Monday's weak quarterly numbers, dipping below €14. The airline reported a 17 per cent drop in ticket prices to €33 per passengers in the three months to the end of December, and said it expects prices to fall further into 2018.

Packaging group Smurfit Kappa, meanwhile, closed the day 1.6 per cent up at €25.28 while building materials giant CRH shed another 0.7 per cent to close at €31.78.

Swiss-Irish food group Aryzta advanced 0.7 per cent to €27.60 while Kilkenny-based food firm Glanbia rose nearly 2 per cent to €16.34.

LONDON The FTSE 100 eked out minimal gains on Wednesday as commodity stocks sank and disappointing results from Hargreaves Lansdown weighed on the market.

London's top tier index closed relatively flat, up 2.6 points at 7,188.82. Investors were reacting to data pointing to rising crude stockpiles in the US, which threaten to counteract Opec supply cuts meant to buoy oil prices. BP shares fell 1.15p to 455.95p while Royal Dutch Shell's 'B' shares were one of the worst performers down 40.5p to 2,208.5p.

The FTSE 100 was also dragged lower by Hargreaves Lansdown shares which fell 22p to 1,364p despite reporting a surge in half-year pre-tax profits to £131 million following a 51 per cent jump in client-driven share deals in the wake of the Brexit vote. However, the Bristol-based investment supermarket warned that the frenzy may not last.

Elsewhere, GlaxoSmithKline shares were flat at 1,562.5p. The pharma giant revealed a 36 per cent rise in underlying operating profits in 2016, thanks in part to a boost from the Brexit-hit pound, but warned of a potential hit from looming competition to its blockbuster asthma drug. Redrow shares rose 18p to 470.5p as the housebuilder posted a 23 per cent rise in half-year revenues to £739 million, saying it saw "very little impact" from the Brexit vote.

EUROPE Among banking stocks, France's Natixis was the biggest loser, down 3.7 percent, while Germany's Deutsche Bank and Dutch lender ING were also among the top fallers in the sector. Elections are also scheduled in Germany and the Netherlands later this year. In spite of the political jitters, a series of good earnings updates has supported the STOXX, which is flat so far this week.

According to JP Morgan, more than half of the STOXX companies that have reported so far beat EPS estimates, with growth at 8 per cent year-on-year. There were more well-received earnings on Wednesday.

French construction and concession company Vinci rose 4.7 8 per cent after it hiked its dividend and forecast higher revenue for 2017 and more traffic on its French motorways.

Spanish builder ACS rose 2.8 per cent after its Australian unit Cimic said it expected a strong 2017 and posted an 11.5 percent rise in full-year profit. Norwegian insurer Storebrand rose 3.3 after reporting forecast-beating earnings and the first dividend in six years, while Danish wind turbine producer Vestas added 2 per cent after a bigger than expected order intake.

NEW YORK US stocks were little changed early on as investors assessed a flood of quarterly earnings reports. More than half of the S&P 500 companies have reported results so far, with their combined earnings estimated to have risen 8.2 per cent - the most in nine quarters.

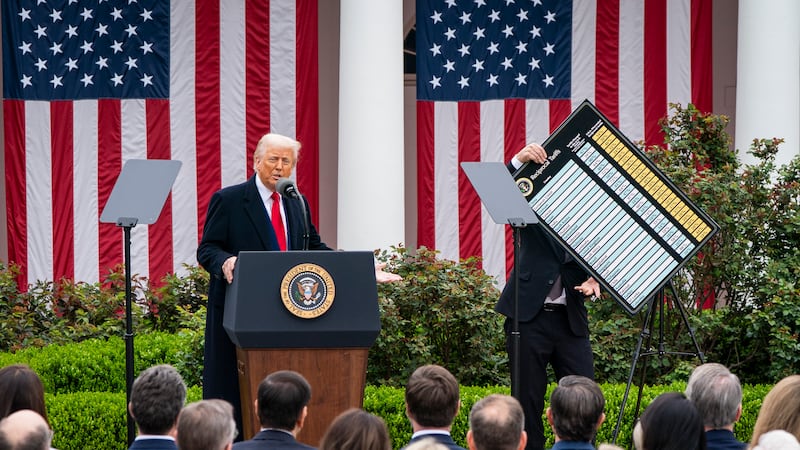

Financial stocks, which have gained the most since Donald Trump's victory in the US presidential election in November, were down 1.11 per cent, putting them on track for their third straight day of decline. Goldman Sachs' 1.2 per cent fall weighed the most on the Dow.

Healthcare was off 0.22 per cent, dragged down by Gilead. The drugmaker's stock, which also weighed on the S&P and the Nasdaq, was down 9.3 per cent after the company projected disappointing sales for its hepatitis C drugs this year. Seven of the 11 major S&P 500 sectors were higher, led by technology shares. Walt Disney was the top stock on the Dow, rising 1.3 per cent after Bob Iger said he was open to extending his term as chief executive. Cognizant rose 3.9 percent to $55.86 after the IT services provider named three directors to its board and announced a $3.4 billion share buyback program, bowing to pressure from activist shareholder Elliott Management.

Additional reporting by Reuters/Bloomberg