If house prices are rising by 12 per cent per year yet wages are only rising by about a quarter of that rate, who is winning? Who gains and who loses from this disparity between house prices and wages?

In Ireland, the growing gap between house prices and wages drives wealth inequality and its byproduct, generational inequality.

Property is wealth in Ireland. Land and property constitute 85 per cent of the wealth of the top 5 per cent in Ireland and the top 5 per cent here own 37 per cent of the wealth of the entire country.

Not long ago old people in Ireland were poor. Today the old are the richest group in the country

Increasingly, the old are the winners in the Irish wealth divide. One of the most dramatic societal developments in the past two generations has been the “greying of wealth”.

Not long ago old people in Ireland were poor. Today the old are the richest group in the country by a long stretch and getting richer.

Such increasing concentration of wealth in the over 70s has huge implications for equality, opportunity and meritocracy in the years ahead.

Inherited wealth is the least meritocratic wealth in the world, but in Ireland it’s still the fastest way to get rich. Inheritance is also the least equitable way of redistributing wealth in a society. It leads to amplification of inequality and a concentration of opportunity in the hands of the merely lucky rather than the hard-working and talented.

But here lies the implicit contradiction at the heart of most market societies. All of us – and I write as a father – strive to do the best for our children, agonising about choices and road maps for their future. Part of this is a natural parental tendency to accumulate wealth not necessarily as an end in itself, but in order to pass it on to your children so they have the best chance.

However, this individual effort becomes a societal dilemma because in economics, what is good for the individual is not always good for the collective. So if you do very well and pass this advantage on to your children, it’s great for your children, but not great for everyone else. This is the wealth conundrum at the core of market democracies.

Inheritance tax

If young workers are being left behind, and wealth is passing upwards to the old via rising house prices, it’s only a matter of time before the young vote for more equality, more redistribution and, maybe in in the years to come, significant increases in inheritance tax.

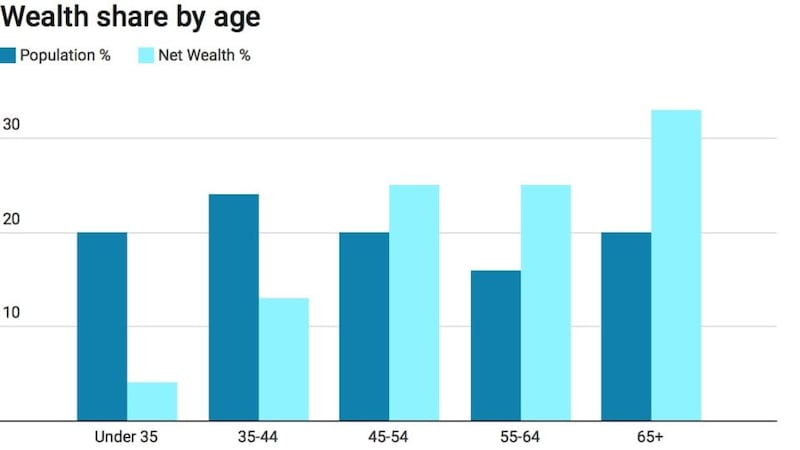

In Ireland today, the oldest cohort of the population owns a third of the wealth, even though they don’t work and constitute only a fifth of the population.

In contrast, Ireland’s 34 to 45-year-olds, who make up a quarter the population, own less than 13 per cent of the wealth.

This is not normal. It implies that the single most significant attribute for wealth creation is patience, not energy.

If wealth inequality continues the way it is going, a wealth tax or hike in inheritance tax is the obvious conclusion. But Ireland is not ready for this move; even the most left-wing parties refuse to support a property tax. As the older people in society exercise their vote more than the younger people, policies will reflect their preferences and biases. This may not always be the case.

Since Reagan, America has followed policies that have increased the return to assets and reduced the return to labour

Trends in Ireland tend to broadly mirror those across the Atlantic in the US, with a lag of a generation, and since the 1980s we have seen huge changes in wealth distribution in America.

In the US in 1983, workers between the ages of 45 and 65 held most of the wealth. The over-70s held a much smaller proportion of national wealth. Today, the over-70s have become by far the richest people in the US. The average wealth per over-70s household is now $270,000. So in the past 30 years the old in America have become very rich, while the rest have fallen behind.

What happened was the presidency of Ronald Reagan. Since Reagan, America has followed policies that have increased the return to assets and reduced the return to labour. Wages in the US have moved sideways, while American assets – stocks, bonds and property – have all risen vigorously. Tax and interest-rate policy have largely driven these moves. Add to this globalisation, which has led to American corporations moving jobs abroad, with the twin effects of undermining employment in the US and keeping American wages down.

Wealth accumulation

We’ve seen similar trends in Ireland, except the focus of wealth accumulation here is almost exclusively property.

In the past decade alone, the policy of zero interest rates has driven up asset prices at a much faster rate than wages. Therefore those who depend on income from assets such as dividends and rents have become much richer. In contrast, those who depend on wages for their incomes – young workers – have fallen behind.

Even if wages are rising, the ratio of wages to house prices is falling. As a result, the young can be falling behind even if they think they are moving ahead. In economics everything is relative.

The implications of this generational shift are profound

Don’t get me wrong: older people are entitled to a comfortable old age. In fact, it is a mark of a civilised society.

As the clock stops for no man, we all have a selfish interest in making sure that older generations are provided for, but has the pendulum swung too far?

As Irish property prices continue to rise relentlessly, those who are sitting on property get richer, and those on the wrong side of that market get poorer. The implications of this generational shift are profound and have enormous consequences for policy and democracy.

On his visit to the US, our youthful Taoiseach has projected an image of a young country, but the reality of Ireland is a country where the old people hold most of the cards, and hold them tightly.