Yes, in the long-run we are all dead, as John Maynard Keynes famously put it, but not before many of us will have to survive a few years – or decades – having to fend for ourselves in retirement.

How will we fund these twilight years? Should you maximise your pension savings, enduring the associated market uncertainty and costs, or put your hard-earned cash to work in an investment property?

Or maybe you’re a so-called “accidental landlord”, renting out your first home as you couldn’t sell it, with vague thoughts of keeping your property to use as a source of income in retirement. Would you be better off getting rid of it now and saving in a traditional pension instead?

We have enlisted the advice of the experts to help you do the sums. It should be noted that the example used is illustrative only, as there are far too many variables to be definitive.

So let’s consider the example of someone aged 40 who has an inheritance of €85,000 net. Keenly aware of the inadequacy of his income in retirement, he is wondering how he can best invest this money today to offer him the best return in 25 or so years,

Option 1: Buy an investment property

Our 40-year-old is nervous about putting all the money into an investment property, particularly given that the home he shares with his family, bought back in 2005, is still in negative equity. But would he be right?

Let's consider an example compiled by Shay O'Brien, a tax manager with PKF O'Connor, Leddy & Holmes. Our putative landlord buys a two-bed apartment for €250,000 in Grace Park Manor, Drumcondra, Dublin 9, with his €80,000 lump-sum, setting aside the remaining €5,000 for stamp duty at 1 per cent (€2,500) plus legal fees and other costs.

As an investor, he can only get a buy-to-let mortgage at a loan to value of 70 per cent, so this caps his purchase at €266,000. In this case, he is going for a €250,000 property, leaving a mortgage of €170,000 over 25 years at a rate of 5 per cent a year, repaying both principle and interest.

The cost of servicing his mortgage in year one comes to €11,925, made up of principal (€3,505) and interest (€8,420). Initially our investor is happy, because he knows, given the location of the property, he should get rent of at least €1,400 a month in the current market, or €16,800 a year, which should leave a healthy excess to plug the gap.

But then he remembers the expenses he’ll also incur: repairs/maintenance of property at a standard industry cost of €1,000 per year; management costs of €1,500; home insurance €130; PRTB registration €90; plus accountants fees of €700 to help him file his tax returns each year, not to mention property tax of €300 a year.

He also remembers his tax bill, but is unsure how to calculate it. Based on the above, the difference between his rent (€16,800) and his total expenses (€15,015) is just €1,785, which, he thinks, means he will just have to pay income tax of about €900 or so for the year. However, his tax adviser has some rather different advice: tax is due on his “rental profits” – which means income less eligible expenses.

Indeed O’Brien says he has a large of book of clients with property investments – and a considerable amount are “accidental landlords” – who are struggling to make their “investment” work.

“Those people are under pressure at the moment,” he says. “What we encounter as the main burden is the income tax and management of properties. The accidental landlords we encounter find income tax hard to deal with. On a monthly basis their mortgage repayments are higher than the rent, so every November it’s a big challenge and their savings are being eroded due to income tax.”

Indeed when our putative property investor adds 75 per cent of his mortgage interest (€6,736) to the aforementioned expenses (less property tax which isn’t an eligible expense) he finds he has taxable rental income of €5,165. This incurs a tax bill of €2,686 which, when combined with property tax and mortgage repayments, means he needs to inject a further €3,431 in order to keep the project running in year one.

It’s a hefty sum which he has to finance out of his own pocket. It also means that, if nothing changes, the landlord will experience a shortfall over the first 10 years of his investment of €3,400-€4,206 each year. Once he gets to year 15, the shortfall will start to rise substantially, as he gets less, and less benefit from the mortgage interest reduction, as his interest bill will be significantly smaller as he pays down his mortgage.

This means that by year 25, when he’s age 65 and due to retire, he will have to inject €6,591 to keep the project running, as his interest bill has shrunk to just €316, with €11,609 going off the principal of the loan.

So how much has it cost our landlord to keep his property over the 25 years? A not insignificant €117,906, plus his original €85,000 investment, which adds up to €202,906. This means that his property has returned a profit of just €47,094 – and he will have to pay capital gains tax, at 33 per cent, should he sell it.

On the other hand, the landlord now has an asset worth €250,000, which also generates an income of €16,800 a year; and it’s something which, depending on the market at the time, he could liquidate and turn into an annuity, as our table shows.

“You’ve kept the head down, held your nerve. In that situation you’re debt free, and you do have an income coming in,” says O’Brien.

But this is based on rents/property prices staying stagnant. If the landlord benefits from a rising market, the upside could be significantly greater. If rents rise for example, at an annual rate of 2 per cent, by year 15, the shortfall has shrunk to €2,237 based on annual rent of €22,167, while by year 25, the landlord will have to inject just €1,685 into the property – of course if rents are rising then other costs may be rising too, which will cut into his gains.

Option 2: Put the money into a pension

What if our investor decided to relinquish all thoughts of investing in property, and instead opened a pension? What would the outcome be in 25 years’ time?

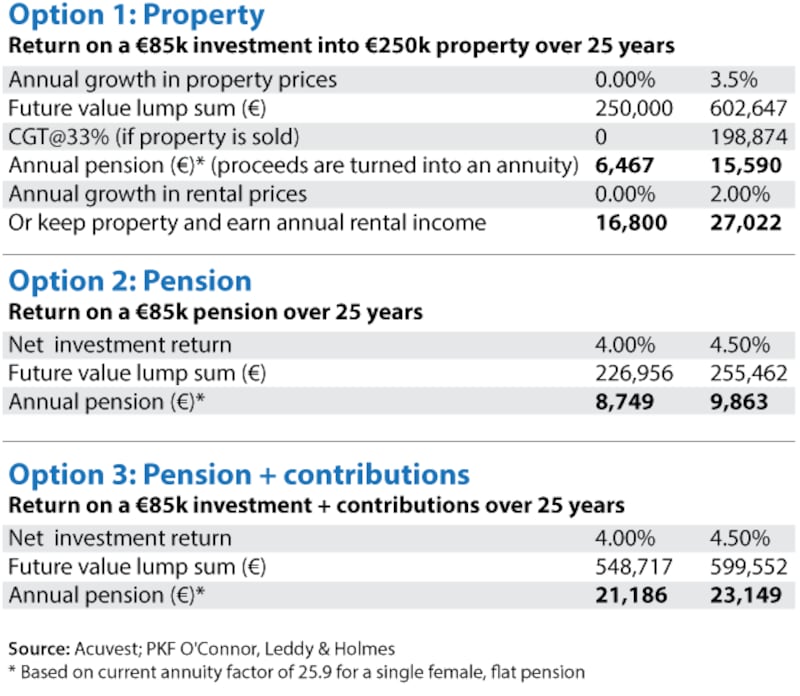

John Tuohy, chief executive of pensions adviser Acuvest, has worked out that over 25 years, a pension of €85,000 will return €226,596 based on an annual investment return of 5 per cent, annual costs of 1 per cent. If taken as an annuity, this would produce an income of €8,749 in retirement.

If he was able to put his money into a group scheme, and therefore avail of lower costs of just 0.5 per cent a year, his return would be greater, at €255,462, which would give an income of €9,863 a year.

A greater income might be achieved by investing in an approved retirement fund (ARF) and drawing down from this.

So which is the best option?

As Tuohy sees it, and as the table shows, the property has the best “potential” to turn your €85,000 into a larger sum and offer the best returns in retirement.

Indeed your €85,000 could turn into €602,647 over 25 years based on annual growth of 3.5 per cent – and it could offer you annual rental income of €27,000, without eroding the value of the property.

“The big pro of a property as a pension is that it has the potential to give you outsized investment returns,” he says. However, he has many caveats to add.

In the above example, would our 40-year-old have obtained a buy-to-let mortgage in the first place? Would he have tenants in situ every month over the 25 years? Are the expenses realistic? For example, what if the property needed a new roof, new windows or significant other repairs? Or what if property prices and rents slumped as our investor approached retirement?

Another issue is, as Tuohy puts it, “the hassle factor”.

“Is the investor up for the hassle factor, dealing with tenants, maintenance, evaluating the risks, costs side of it? Some of the reasons people will sell before they get to retirement have nothing to do with pensions – it’s about no longer having the stress of keeping everything going,” he says.

Another issue is the “d-word”: a typical retiree will already own their own home outright, so will have a certain exposure to property – and taking on an investment property could see them overly concentrated in the asset. This lack of diversification for someone who doesn’t have, on the other side, a €1 million-plus pension fund, could be problematic if the investment was to turn sour; something many people in Ireland will have keen experience of.

“[Property is] unlikely to be a great idea for someone who’s entire quality of life depends on whether or not a specific property investment works out,” says Tuohy.

Liquidity

“[Property is] not an asset that is quickly or readily convertible into cash,” says O’Brien, pointing out that costs are always liable to increase.

“An increase in interest rates is a danger at the moment,” he says. While you might face a shortfall of €2,500 on the property now, in two or three years it could be €3,500, or more.

Pensions, on the other hand, come with favourable tax treatment, with contributions eligible for tax relief of up to 40 per cent, and pensioners entitled to a tax free lump sum of up to €200,000 on retirement.

“My view on pensions is that no one is going to give you 40 per cent back on a relief in this point of time at the moment,” says O’Brien. “Arguably it’s more attractive to make pension contributions.”

So what if our investor puts his €85,000 into a pension fund and adds the net cash flows he would have spent on the property – ie the loss the property makes and the amount the person has to fund themselves – into the fund? Availing of tax relief at 40 per cent, he could build up a pension fund of up to €599,552 based on annual growth of 4.5 per cent, which could give an income on an annuity of €23,149 a year – without all the hassle a property means.

And unlike a property, you’ll never have an income tax bill arising every year on a pension investment. While you will incur costs, in the form of annual management fees, as Tuohy notes, “you’re not writing a cheque for this”. Of course tax savings can be achieved if you can afford to set up your own pension structure which can then acquire a property, but you may need north of €500,000 to invest for this to make sense.