It's known as a house hack. And no, it doesn't have anything to do with Ikea. It's the latest investment craze sweeping the internet, and has become popular in the US where multifamily homes are common.

House hacking allows you to live in a home without actually paying for it thanks to the rent provided by other tenants. And, given our rent-a-room scheme, which allows you to earn €14,000 tax-free from letting rooms in your house, Ireland may actually be a good place to try it out in.

But what is it, how can it work and will it make you a millionaire?

Put simply, house hacking involves you buying a home – the more bedrooms the better – and filling those rooms with tenants, who will then cover the cost of all, or most, of your mortgage and other expenses.

Unlike just getting a tenant to help you pay your mortgage, the goal of house hacking is to get the tenants to pay all your mortgage, thus allowing you to either live it up in style, reinvest the funds or pay down your mortgage with prompt haste.

It is still often cheaper to buy rather than rent, so buying might make sense for reasons other than a 'house hack'

The proposition can make sense in an Irish context, particularly given that it can still be cheaper to buy rather than rent, while the rent-a-room allowance means you can also earn €14,000 a year tax-free from renting out a room/s in your home.

Remember, the rent-a-room scheme was adjusted slightly in the recent Finance Bill, which means only lets for 28 days or more qualify for tax-free status. But with a house hack, this won’t be an issue, as it’s based on long-term, rather than short-term, lets.

Rent vs buy

Yes, house prices are expensive, on the back of a number of years of double-digit growth. However, it is still often cheaper to buy rather than rent, so buying might make sense for reasons other than a “house hack”.

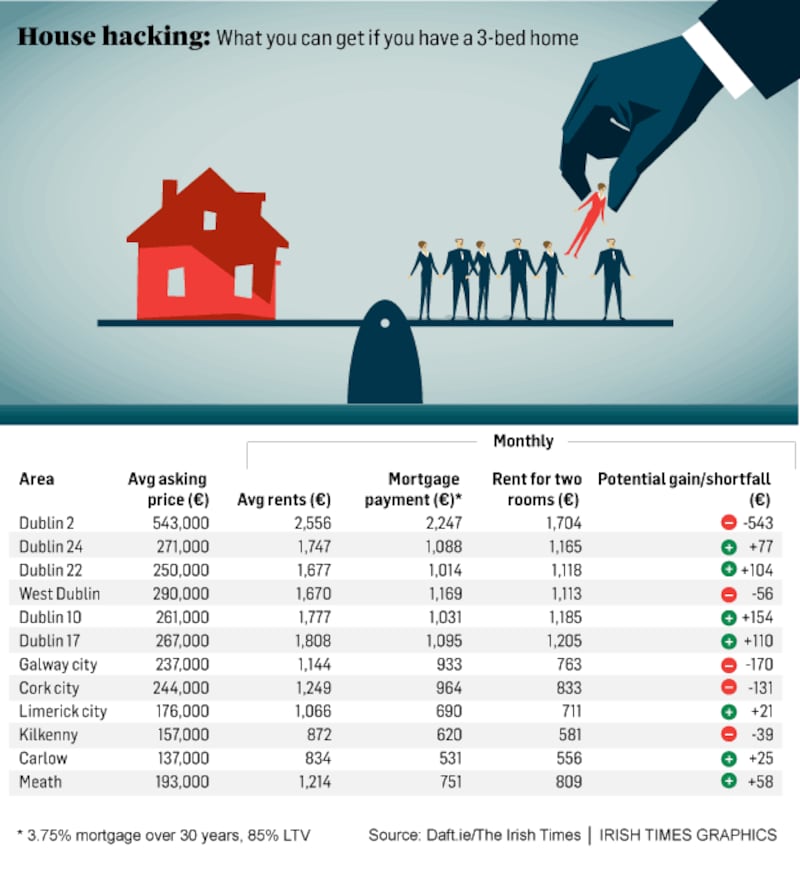

According to Daft’s figures for the second quarter of the year, for example, a two-bed house in Dublin 2 will cost €1,744 in mortgage repayments, or €2,168 in rent, while a three-bed house in Galway city will cost €933 a month for a mortgage, or €1,144 to rent.

If you are looking at buying a new-build home, you can also avail of the help-to-buy scheme to help you get your deposit together. It gives you your tax back for 5 per cent of the value of the property up to a maximum of €20,000.

Outside Dublin

At its most simple, you’re going to want to buy in an area with cheaper house prices, yet with decent rents.

Look at Carlow for example. The average three-bed home here will cost you €20,000 less than neighbouring Kilkenny, but rents are almost on a par, at €834 a month compared with €872 in Kilkenny, according to figures compiled by Daft.ie.

This means that letting two rooms for €556 a month will meet the cost of your mortgage (€531) in Carlow, but not in Kilkenny (rent of €581 versus mortgage of €620).

You can also look to boost your returns by taking the smallest room in a typical three-bed property yourself, and renting out the other two for 75 per cent of the total rent the property could make. Doing so would actually give you a surplus of €95 a month in Carlow, and €34 in Kilkenny.

The best deal however is to be found in Meath. If you achieved rent of €911 from renting two rooms in the property, you could stand to make yourself €160 a month – enough to cover your broadband, heating and electricity bills.

Inside Dublin

Making the sums stack up so that your tenants will effectively pay you to live in your own home may be more challenging in Dublin but the rewards can also be greater.

Consider a three-bed semi-detached home in Dublin 10. According to average asking prices in the area, which includes Ballyfermot and Cherry Orchard, you can buy such a property for about €261,000, with a monthly mortgage repayment of about €1,031.

If you rented two rooms in the property, you could have a surplus up to the tune of about €154 each month, or €1,848 over the course of the year. And if you were even more strategic about it, and opted for the smallest room yourself, you could boost your rental income to €1,333 a month, which means you’d be up a staggering €302 a month, or €3,624 a year.

Pursuing such a strategy in the pricier areas of the capital may be a lot more difficult. In Dublin 2, beloved with Googlers and techies and home to the Grand Canal Dock, you can expect to pay about €543,000 for a three-bed property. And, while you might make as much as €1,917 by renting out two of the bigger rooms, you’ll still be short €330 a month on your €2,247 monthly mortgage payment.

Of course this means that you get to live in that area for just €330 a month, which is no mean feat.

But there is a further complication that potential home hackers need to be aware of: the rent-a-room scheme only allows you to earn €14,000 a year tax free. Earn €1 more a month and you’ll be looking at paying tax at your marginal rate on the entire income.

If you’re buying and renting outside of Dublin, it’s unlikely you’ll be able to generate rent of more than €14,000 a year, unless you’re renting four or more bedrooms.

What's to stop you from doing something with the money you would have otherwise spent on your mortgage/rent, to beef up your future financial health?

In Dublin, however, you’d be surprised at how quickly you can reach this threshold. In Dublin 17, achieving current market rents of about €1,200 for two rooms will net you €14,464 a year. That would leave you exposed to tax on the whole sum so you’d be better off cutting rents slightly to keep them within the €14,000 limit.

And in Dublin 2, overstepping the €14,000 limit will likely be a very real concern, given the heady rents achieved in the area.

Money saved

If you manage to achieve a near-rent/mortgage-free existence, your question then might be, what, if anything, you should do with the money you would have otherwise spent.

One approach is to allow others pay down your mortgage, and simply enjoy the benefits of getting to keep a significantly larger chunk of your pay cheque than you otherwise would do. Figures from Sherry FitzGerald last year showed that Dublin dwellers gave up 55 per cent of their takehome pay on rent: this could be 55 per cent you get to keep.

On the other hand, what’s to stop you from doing something with the money you would have otherwise spent on your mortgage/rent, to beef up your future financial health?

Let’s consider our aforementioned property in Ballyfermot. If you still put your €600 into the mortgage each month, you’d bring your monthly repayments up to €1,631 – and save yourself a staggering €81,000 in interest over the term of your loan. You’d also manage to pay it off in just 15 years, leaving you mortgage-free with a home of your own.

And if you put the €300 a month you’re actually making on the property into your mortgage too, you’d cut your interest payments again, and knock another three years off the term of the loan.

Possible challenges

While “nothing ventured, nothing gained” might be true, it is also true that for all the gains to be potentially made from house hacking, it is not without challenges.

The first is saving for a deposit. With the typical deposit now needed to buy a home in the order of €37,000 outside of Dublin, or €55,000 in the capital, it can be a sizeable challenge. Getting a mortgage can also be difficult, while, with supply still tight, finding an appropriate property – and one that works not just as a “house hack” but also as a home – can be tough.

Third, it might be wise to run the numbers quite a bit before you commit; yes rents are soaring today, but will this be the case in five years’ time, and can you still afford to maintain the property with lower rent expectations?

Finally, if a tenant is not working out, you will have to sort things out with them or ask them to leave.

When people rent a shared room, this is not covered by the Residential Tenancies Board, but rather is structured as a “licensee agreement”. This means tenants are staying in your home by your consent or invitation. That means issues around notice etc won’t apply if you ask someone to leave; but similarly if someone isn’t paying their rent, you don’t have the resources of the RTB to fall back on.