After the damp squib that was last year's Brexit-flavoured budget, it would have been reasonable to expect one sprinkled with more giveaways this time around. However, the coronavirus pandemic means that Budget 2021, framed as it is against such a background as well as the end of the Brexit transition period, is unlikely to offer much change – either for good or bad.

For now, Government strategy is to borrow to cope with the crisis, so there is no imminent threat of either austerity or swingeing tax cuts, at least while the global debt markets remain so benign.

Where the State coffers allow for incentives, these will likely be targeted at businesses rather than individuals.

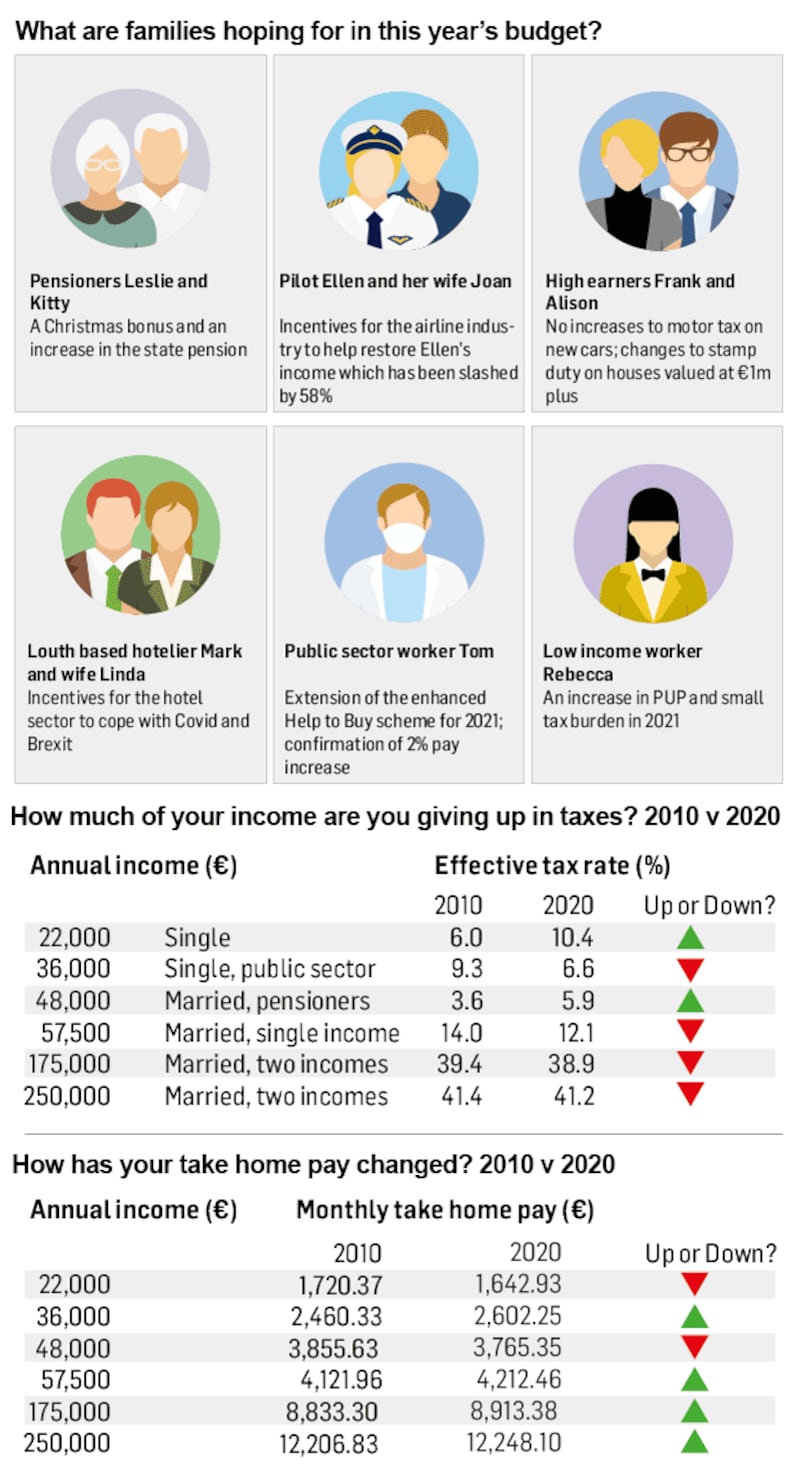

Nonetheless, there will undoubtedly be some announcements, as we take a look at what families across Ireland might expect come next Tuesday October 13th.

Income taxes

He has been urged to spend to stimulate the economy by the Irish Fiscal Advisory Council, but Minister for Finance Paschal Donohoe has already ruled out any changes to income tax, including USC and PRSI. But there might be slight tweaks.

Certain medical card holders and those aged over 70, for example, only pay USC at a rate of 2 per cent. This is due to run out at the end of the year, but might be extended once more.

Broadly speaking, however, it means that our families are unlikely to see any substantial changes to their take-home pay come January. The problem for some is that they have yet to recover their 2010 after-tax income. Our waitress Rebecca, for example, earning €22,000, brought home €1,720 a month back in 2010; this year it’s just €1,643.

As Lisa McCourt, a senior tax manager with PwC, notes: "With no planned adjustment to income tax rates and bands, after-tax income in 2020 and 2021 will still lag behind comparable after-tax income in 2010."

Others have fared better, both from taxes and in avoiding a pandemic-related hit. A couple earning €250,000, for example, now brings home slightly more each month (€12,248) than they did back in 2010 (€12,206), thanks to improvements in their tax situation in the intervening years, and will likely still do so come January 2021.

With no change to the tax bands, particularly the ceiling on the lower rate of €35,300, those on the precipice of the higher-rate tax band will have to stay there, such as our public sector worker Tom, who earns €36,000.

A recent Revenue publication gives the cost of moving the standard rate band up to €36,800 at some €257 million a year.

Wage supports

A feature of this year's budget is the hundreds of thousands of people who are currently on wage supports, be it the Pandemic Unemployment Payment (PUP) or the Employment Wage Subsidy Scheme (EWSS).

Like Rebecca, the 32-year-old pub waitress from Kildare. Since Covid-19 restrictions were introduced, she has been out of work and on the PUP payment. It has helped keep her income steady so far this year but, like others on the payment, she is fearful of how much tax she might owe in future years and would like to see the recently reduced payment increased again.

An increase in such payments is unlikely in the budget, but the Government may look to put aside funds to provide more support for training and upskilling for such workers.

Work from home boost

With winter drawing in, the costs of working from home are set to rise. At present, home workers can cover their costs in one of two ways: either their employer pays them an allowance to compensate for home expenses, or they make a claim against their taxes.

In the first instance, an employer can pay an allowance of €3.20 a day which is tax-free; anything over this and the allowance becomes a taxable benefit.

Should you make a claim yourself, you can claim relief on 10 per cent of heating, lighting and broadband bills for days worked from home, at your marginal rate. However, this might work out at less than €50 a year, which will hardly compensate for having your heating and lighting on all day, not to mind the costs of broadband etc.

As a result, some tax experts say that the budget might look to offer home workers a boost.

“Introducing measures expanding the deductibility of costs relating to remote working or support for upgrading home offices would be well received,” says McCourt. Donohoe himself alluded to this in recent days, noting that there should be “equity” between working from home and in the office, and he will examine such tax reliefs in the budget.

Sector-specific supports

Unusually perhaps, this year many employees will be hoping for State help for their employers rather than a tax break for themselves so that they can retain their jobs and recover lost earnings.

The airline industry is one where this is keenly felt, with our pilot, Ellen, for example, having seen her earnings slashed by 58 per cent. She has managed to supplement her income through the rent-a-room scheme, which allows her earn up to €14,000 a year tax-free.

Similarly, small business owners, such as Louth hotelier Mark, will be looking for financial help.

Housing

Putative homebuyers like Tom, a nurse earning €36,000, will be hoping that the Government brings forward some of its promised housing initiatives. One of these is Help to Buy. With the increase in the tax rebate offered under the scheme to 10 per cent of the purchase price back in July (up from 5 per cent previously), he is hoping that the Government will go one step further and extend this beyond the end of the year, as the enhanced rebate is due to end on December 31st.

On the other side, of possible concern to higher-earning families are potential changes to stamp duty if they're in the market for a new home. Stamp duty rates have not been changed since 2010 and could be a source of revenue at the higher end. This was mooted in the recent Tax Strategy Group papers. The Revenue Commissioners estimate that adding a surcharge of 1 per cent on properties sold for €1 million or more could bring in an additional €9 million a year.

Christmas bonus and welfare payments

It was only restored in full in the 2019 budget, but the Government has yet to give a commitment on whether or not it will pay a Christmas bonus in this year's budget. The bonus offers welfare recipients, such as those on the state pension and one-parent family payment, a double payment at Christmas. The mood in Leinster House appears to dictate that this payment will be made.

However, it’s now seen as unlikely that the €5 increase in the State pension, which had become a stalwart of recent budgets, will be a feature this year.

Fuel and motoring

With carbon tax set to rise by €7.50 a tonne, as laid out in the programme for government, consumers can expect to pay more for their fuel next year – an extra 1.5 cent on a litre of diesel or €86.52 on 900 litres of home heating oil.

Drivers of diesel cars could also see excise on this fuel increase to bring it into line with petrol, while the Tax Strategy Group proposals on vehicle registration tax could make the cost of a new car punitive. For example, Volkswagen has estimated that the cost of a Tiguan crossover with a 2-litre diesel engine could rise by €6,335 if the proposals were implemented in full.

Self-employed

While it had been mooted that those working for themselves should pay more PRSI to cover their increased benefits, the uncertainty of the economic environment means that this is now unlikely to happen.

Currently, the self-employed pay PRSI Class S at a rate of just 4 per cent. However, the benefits they enjoy have been steadily increasing in recent years, and now include sick pay as well as dental treatment.

As a result, the Tax Strategy Group recently suggested a move in this rate to bring it up to the same level as that paid by employers – 11.05 per cent – over four budgets. This would mean an increase of 1.75 per cent each year for three years and of 1.8 per cent in the fourth year.

Moving to 5.75 per cent next year would bring in an additional €230 million of revenue for the Government, but at a cost to the self-employed. For example, income of €50,000 would see the PRSI burden increase from €2,000 to €2,875 – an increase of a not-insignificant €875 a year.

On the other side, the self-employed were also promised a further equivalence with the PAYE sector. Introduced in 2016, the earned income tax credit aims to close the gap between what someone working in the PAYE sector, and someone who is self-employed, has to pay in tax. It has been increased regularly since then and currently stands at €1,500. However, this is still less than the PAYE tax credit of €1,650.

While PwC’s McCourt notes a move to equalise the rates would be “very welcome”, it remains to be seen whether or not the Minister will assign funds to the credit this year.

Inheritance tax

Some years back, the then government vowed to bring the tax-free threshold for parent-to-child asset transfers up to €500,000, which would mean a child could inherit property or assets worth up to this limit without handing over a penny to the tax authorities.

But clearly circumstances have since changed, and the recent Tax Strategy Group publication has suggested that capital acquisitions tax (CAT) could be a source of revenue for the exchequer. Revenue could be raised, it says, either by increasing the rate of CAT (currently 33 per cent), reducing the group exemption thresholds or changing the small gifts exemption.

Reducing the group A threshold, which covers parent-to-child transfers, from €335,000 to €300,000 would yield €26 million a year, for example, or €76 million if it was brought back to €225,000.

The strategy group suggested that consideration could also be given to increasing or reducing the small gift exemption, which allows payments of €3,000 to be made to other people tax-free every year.

“It may be appropriate to allow its use only within immediate family members,” the group said.

This could worry older parents, like our pensioners Leslie and Kitty, who are hoping to pass on their assets tax-efficiently to their offspring.

Savings

Another item mooted for revenue-raising is deposit interest retention tax (Dirt), with the tax group suggesting that an increase in the rate of tax from 33 per cent to 41 per cent, or somewhere in between, could be considered to both raise tax revenue and get people spending.

“The rationale for this would be to act as a disincentive to hold money on deposit and encouraging spending in a time when an economic stimulus is needed,” the group said, adding that it would also reduce the differential between the rate of Dirt applied to life products (41 per cent).

However, with interest rates on the floor, such a move would yield relatively little; an increase in the rate from 33 per cent to 35 per cent would bring in just €3 million a year, or €10 million if increased to 39 per cent.