In the midst of a pandemic it may seem a ridiculous question. But financial markets are starting to ask whether, as we emerge from the pandemic, inflation – and thus long-term interest rates – may pick up.

On Wednesday, the US Congress passed a massive $1.9 trillion (€1.6 trillion) stimulus plan to respond to the pandemic. Debate is raging on whether this is a vital support, or risks setting off inflation and eventually higher interest rates. On Wall Street, long-term interest rates on the bond market have risen sharply.

Whether inflation is on the way back or not – and what this means – is one of the most fiercely debated issues in economics today, with implications for financial markets and economies across the world, including Ireland.

1. The big row

The debate over whether the Biden plan risks sparking inflation is, in terms of economic pedigree, a heavyweight contest. On one side are the likes of Larry Summers, treasury secretary in the Clinton administration and one of Obama's top economic advisers and Olivier Blanchard, former chief economist at the IMF. They argue that the Biden plan will push too much cash into the economy. Summers has said it could trigger "inflationary pressures of a kind we have not seen in a generation". Blanchard likened it to the old fable of the elephant swallowed by the snake. "The snake was too ambitious. The elephant will pass, but maybe with some damage."

On the other side of the argument are economists such as Paul Krugman and new treasury secretary Janet Yellen. She argues that the real risk is unemployment and slow growth. If inflation does emerge, then the US Federal Reserve can deal with it, she says. Krugman says the critics have it wrong and that the pandemic cannot be treated like a normal economic downturn and is more akin to a natural disaster, when a massive response is warranted to avoid huge economic costs and risks.

2. The key points

The critics base their arguments on estimates of the current state of the US economy. Economists often use a concept called the output gap, which is the space between the rate at which the economy is operating now and its potential growth rate. It is a nice idea, though hard to calculate with precision. Summers and Blanchard estimate that the stimulus plan is more than three times as large as the current output gap – and possibly four to five times. They also say it concentrates too much on boosting incomes –including via a $1,400 cheque to households earning under $75,000 – and not enough on infrastructure, which increases the productive capacity of the economy.

The risk, they argue, is a revival of inflation and the danger that the Fed needs to respond via higher interest rates, potentially choking off growth and causing significant market instability, not only in the US but across the world.

Krugman says the critics of the Biden plan have it wrong. Responding to Covid is like responding to a major natural disaster or a war, he said. In a recent blog, he wrote: “ When Pearl Harbour gets attacked, you don’t ask, how big is the output gap.”

Krugman argues that going big is justified given the massive scale of the economic damage and calls for Congress to follow approval of the $1.9 trillion rescue plan by supporting other Biden plans for a major boost to investment in the years ahead, contained in a “ Build Back Better “ programme.

This is vital to put the US back on a strong growth path, he argues, and to avoid the continuation of relatively low growth seen since the financial crisis.

Previous fears that stronger growth would spur inflation were wrong, he says, arguing that the US economy could be “run hotter” without risking price rises, partly because people’s expectations of future inflation are low, based on the experience of recent years. Inflationary expectations are a key part of the theory used by central banks, with a view that if the expectations of consumers and businesses are set to inflation, then this is vital. And the problem in recent years has been that inflation has been too low, not too high.

3.The fallout

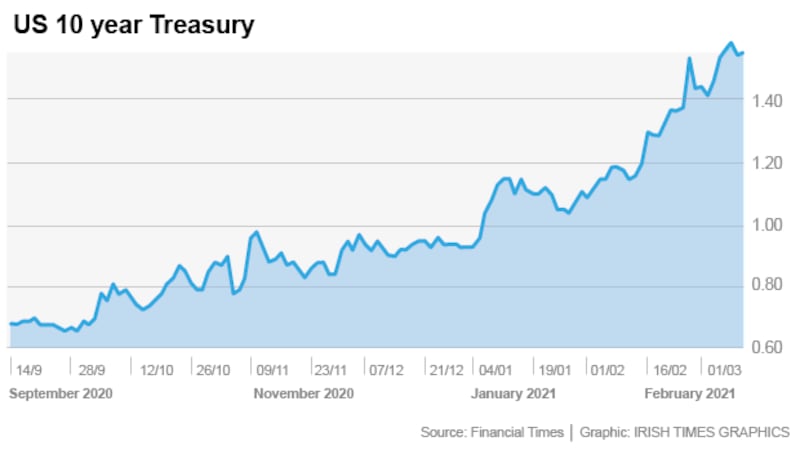

The debate, and figures showing the inflation rate has climbed from 0.2 per cent in May to 1.4 per cent now, has led to some nerves in US bond markets. The 10-year interest rate has risen from 0.6/0.7 per cent last Autumn to 1.5 per cent now. In turn this has led to tremors in equity markets. As we have no historical basis for an economy emerging from a pandemic shock, we just don't know what impact the Biden boost will have, or what it will mean for inflation and interest rates. Fed chair Jay Powell has said that the real rate of unemployment is probably closer to 10 per cent than the 6.3 per cent shown in official data, leaving significant slack in the economy. Yellen, a former Fed chair, said she had spent many years studying inflation and worrying about it, but that responding to the pain and economic suffering caused by the pandemic was more important.

4. Why it matters to us

What is happening in the US is important to the economic outlook for a number of reasons. First, the price of US bonds is a vital marker for world markets – if US bond investors do take fright, then the impact will be felt on the US dollar and on equity markets across the world. So we need to watch the key US indicators – such as inflation and wages – and how the Fed responds.

In 2013, warnings by the Fed that it would wind down its bond purchases put in place after the financial crash rattled world markets and led to what was dubbed a “taper tantrum”. Now the Fed has said that it would let inflation overshoot the 2 per cent target and there is no sign of tightening. But with the headline inflation rate due to rise over the summer – partly because some prices fell during lockdown last year – then nerves could be on edge. And when central banks do come to wind down pandemic support, it will be a delicate job.

Second, a rise in US bond interest rates raises the question of what happens in Europe as it moves out of the pandemic and returns to growth. Europe's collective budgetary response is not on the US scale, though individually countries are spending significantly. EU inflation, which was 0.9 per cent in January, is expected to rise sharply in the months ahead, possibly even touching 2 per cent due to a temporary bounceback in some prices. However after that it is likely to fall back.

Euro zone bonds fell in prices – meaning long-term interest rates went slightly higher – when the US market was hit by a bout of nerves in February. Since then prices have eased back a bit, though interest rates remain above last year’s lows. The question now is whether euro zone bonds could be hit in the fallout from US nerves – and how the ECB would respond.

This is one to watch, particularly later this year year. The big question is what happens to long-term interest rates when the ECB starts to wind down its bond buying programme. Assuming growth picks up later this year, this will be a big question heading into 2022. The ECB has said it will phase out its programme very slowly – and it could come under pressure to maintain a high level of market support for some years. It all depends on the pandemic.

Bond interest rates have appeared ridiculously low for some years, given that the ECB targets inflation of 2 per cent. But this inflation has not appeared and the pandemic response has driven long-term interest rates even lower. The Republic is most unlikely to be able to borrow at negative interest rates in the longer term. But in the next year or two might rates return to, say modest levels of up to 1 per cent seen in 2017 and 2018? Or will the future look different with a gradual return of inflation and higher borrowing costs ? The coming months will give us some vital clues.