The Department of Finance is keeping a close eye on the existential crisis facing the Irish Stock Exchange. Only three companies have joined Euronext Dublin, as the exchange is now known, over the past four years. Greencore, C&C, Applegreen, Aryzta and Diageo are among the departures. CRH, the biggest company on the exchange, is moving its primary listing to America; and Flutter, owner of Paddy Power, might do the same.

If both were to leave, it would cost the exchequer up to €250 million a year in stamp duty. That’s because of a 1 per cent tax on every share purchase.

This potential loss is now concentrating minds on Merrion Street. The department said it would not comment on any announcement by Irish issuers as regards their listing intentions. “However, in light of potential impacts on tax receipts and more generally Irish capital markets, officials have been engaging with Euronext Dublin and relevant market participants with a view to better understanding the issues at hand. Officials remain open to continued engagements.”

Euronext Dublin declined to comment, but we hear it is preparing a report for the department. What could the Government do to help? Cut the transaction tax to 0.5 per cent, perhaps. Reducing capital gains tax for business founders who sell shares in an IPO might encourage new listings. The last IPO of any consequence in Dublin was Uniphar’s. That was in July 2019.

Guessing game on Ryanair’s Boeing discount

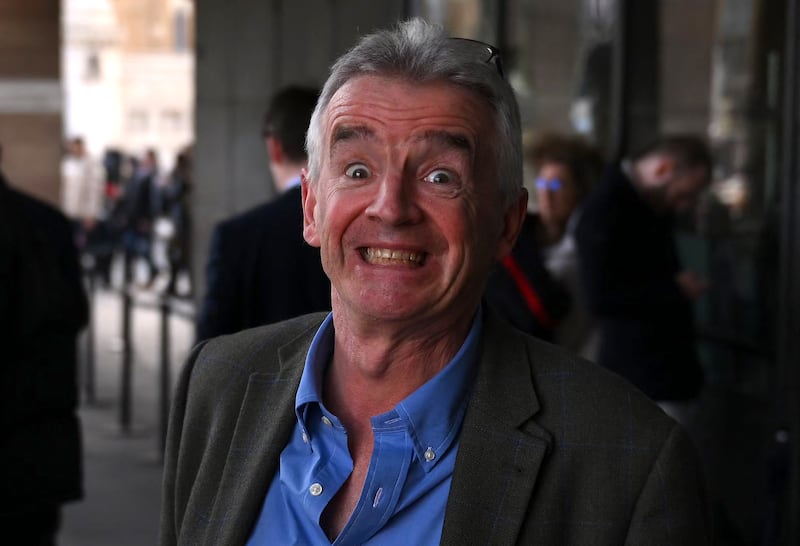

Just how much is Ryanair paying Boeing for its new aircraft? The sticker price for the 300 Max-10s it has ordered is $40 billion (€36.9 billion), but nobody thinks Michael O’Leary is coughing up $133 million per plane.

“I have been told to say there was a competitive discount, although I don’t think [it] was particularly competitive,” O’Leary quipped at the announcement press conference.

Aviation analysts have been giving their guesstimates of just how big a discount Ryanair got. Bernstein believes it paid $38 million per plane. Barclays based its calculation on the fact that Ryanair reckons its capital expenditure for 2027 will be above €2 billion annually. “If we assume some €500 million of maintenance capex, this would hypothetically imply a price in excess of $44 million per aircraft,” it said.

Morgan Stanley’s hypothesis is much higher. “Based on rough current market values, and assuming a discount of about 5 per cent ... we estimate a purchase price of roughly $57 million,” it said.

Many industry watchers await the calculation by Robert Boyle, a former strategy director of IAG. Working from Ryanair’s accounts, he calculated that it paid Boeing $27.1 million per plane in 2005, and €35.8 million in 2013.

“I’m sure they didn’t secure the same level of discounts they got in the past,” says Boyle. “That is simply based on the fact that Ryanair really needs the aircraft and there is a shortage of supply in the market. [The price] will definitely be higher.”

Given that Ryanair’s plan is to fund the planes from internal cash flows, we will find out eventually.

Kelly nets Serena Williams at Consello

Declan Kelly has signed up another sports superstar to be a “senior adviser” at Consello, his financial services advisory company. This time it’s Serena Williams, winner of 23 Grand Slam singles tennis titles. She retired from tennis last year to “grow” her family and develop the venture capital company she formed in 2017.

Williams joins ex-American footballer Tom Brady and former basketball player Pau Gasol on the advisory board at Consello, which the PR guru from Tipperary launched in 2021.

“I have been extremely impressed with the progress Declan and the entire team at Consello have made since the launch,” says Williams in a statement on its website. She add that the team of senior executives Kelly has brought together “is, in my opinion, one of the best in the world already”. Looking forward to “a long and mutually successful partnership” with the company, Williams professes herself “very energised by the opportunities that lie ahead”.

Consello says Williams will work with its clients and portfolio companies “on various strategic matters”.

Pigsback’s illustrious alumni gather for memoir launch

Pigsback.com, a discount deals and rewards website, was launched in Dublin’s Grand Canal Dock on a hot day in July 2000, its founder Michael Dwyer recalls in his new book, From the Arena, based on journals he has kept over two decades in business.

The colour pink was the theme of the launch, with pink cocktails served to guests, many decked out in pink shirts and dresses. Dwyer’s sister, Geraldine, recruited two on-street promoters from Dundalk, one called Brian, who arrived in pig suits. At one point Brian took off his pig’s head to get a breather, putting it down beside him on a wall. Whereupon a local rascal zoomed up on a bike and grabbed it.

“Brian must have felt that the very success of Pigsback was in his hands when, in full pig regalia, he gave chase,” writes Dwyer. The thief was clearly surprised by the speed of the pursuing porcine, since he dropped the head, and Brian brought back the bacon. “Now that’s commitment,” marvels Dwyer.

From the Arena, edited by the writer Gavin Daly, was launched at the Cafe du Journal in Monkstown last week. Master of ceremonies was Gareth Lambe, an early Pigsback employee who became head of Meta in Ireland. His successor Anne O’Leary was among the attendees – she, Lambe and Dwyer are neighbours in Monkstown.

Also spotted were Cillian Barry, another ex-Pigsbacker, who sold his gaming company SportsCaller business to the American casino corporation Bally’s for €40 million; and Dwyer’s brother John, chairman of Renatus, a private equity firm.

RTÉ's Player finally a player

The RTÉ Player was once called “perhaps the most notorious software ever created in Ireland” and a “glitchy abomination” by a TV critic of this newspaper. Quietly, though, Montrose has sorted it out. Audience numbers are growing, and there are fewer criticisms about the online streaming service stalling, or about the ads looping instead of the programme playing.

RTÉ has told me that streams this year are up 20 per cent, at 31.4 million, with time spent viewing up 50 per cent. That follows a successful 2022, with 80 million streams, up 18 per cent on the previous year.

Sport accounted for 11.9 million streams last year, including the World Cup in Qatar, and the Republic of Ireland qualifying for the Fifa Women’s World Cup. This year’s rugby Grand Slam naturally proved popular, with 621,000 streams recorded.

Box sets are the biggest draw, though, and accounted for 15 million streams last year. Normal People had 1.1 million of those, bringing the total since its release to 7.2 million. With Netflix in decline, might RTÉ’s streaming service finally be a player?

Learning from incarcerated Harry Cassidy

Even though he is now serving a sentence of six years and 10 months for conspiracy to defraud investors, Harry Cassidy is still offering to teach English online. Courses by the former boss of Custom House Capital are being advertised on Udemy for as little as €9.99, including one called The Most Common Mistakes in English and How to Avoid Them. The price represents a steep discount on the original €79.99.

Cassidy seems to be better at teaching than he was at investing. His instructor rating on Udemy is 4.5 out of five, based on 969 reviews from the 27,501 students who took his courses.

It’s not clear how incarceration will affect Cassidy’s new career. Could he one day become the Andy Dufresne of the Irish prison system?