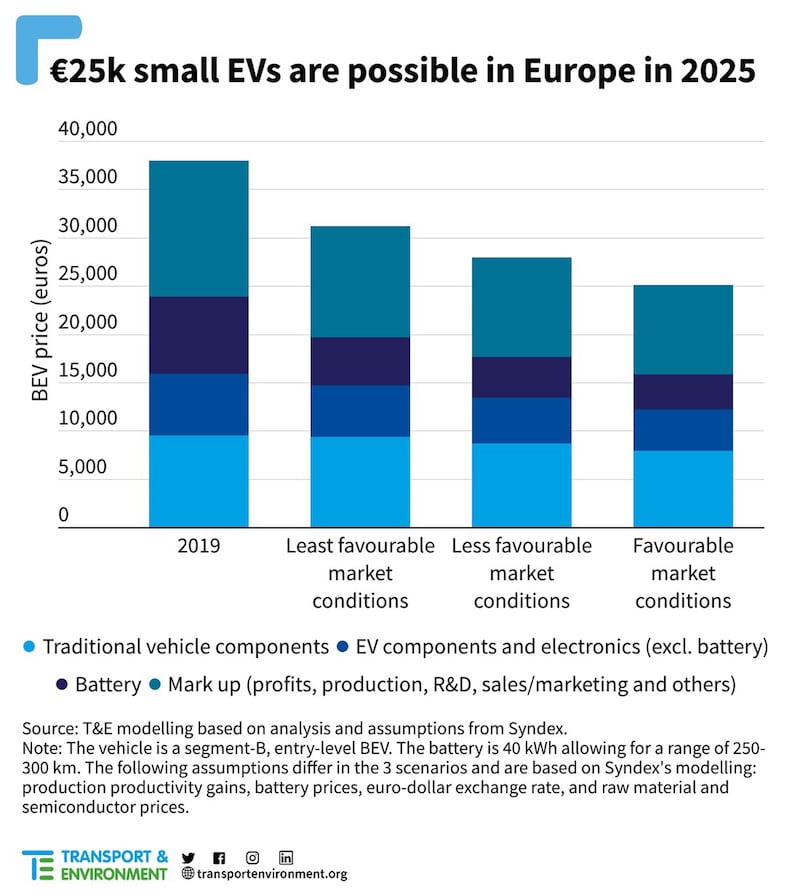

Carmakers will sell small electric cars made in Europe for €25,000 while making a profit within two years, which may be a game-changer for the European Union’s motor industry, according to an analysis by a leading environmental non-governmental organisation (NGO).

Falling production costs and battery prices would make what are known as “mass-market B-segment vehicles” feasible to electrify by 2025, according to the study by Transport & Environment (T&E).

It concludes that the availability of smaller and more affordable EVs “could be a game-changer for mass adoption of electric cars and will be crucial if European carmakers are to hold off the challenge of Chinese companies surging into Europe”.

European manufacturers would make a reasonable 4 per cent profit margin on a small battery electric vehicle (BEV) produced in Europe in 2025, according to the report’s “favourable market conditions” scenario.

RM Block

This would see battery costs fall to $100 per kilowatt hour (kWh), in line with forecasts by BloombergNEF and others. The report, conducted by the Syndex consultancy, factors in other direct cost reductions while keeping broad industry expectations around indirect costs and markups.

It is envisaged that the typical small EV would have a 40kWh lithium battery and a range of 250-300 km.

Julia Poliscanova, T&E director for vehicles and emobility supply chains, said: “Survey after survey has shown prices are one of the biggest barriers to drivers going electric. The €25,000 small BEV will be a game-changer for public adoption of electric cars.

“Bringing those models to market quickly and in volumes is crucial for European manufacturers to compete with Chinese rivals which are already offering cheap, small electric cars here.”

European Commission president Ursula von der Leyen announced this week that Brussels would open an anti-subsidy investigation into Chinese electric vehicles that are “distorting” the EU market.

The inquiry could constitute one of the largest trade cases taken as the EU tries to prevent a replay of what happened to its solar industry in the early 2010s, when photovoltaic manufacturers undercut by cheap Chinese imports went into insolvency.

“Global markets are now flooded with cheaper electric cars. And their price is kept artificially low by huge state subsidies,” she said.

The arrival of more affordable, small EVs would hasten uptake of zero-emission cars in Europe, a separate T&E survey shows. A quarter of new car buyers already intend to buy an electric car in the next year, according to a YouGov poll for T&E of 3,031 adults in France, Germany, Italy, Spain, Poland and the UK.

But when given the option of a small €25,000 EV, the share of new car buyers willing to buy a battery electric model increases to 35 per cent. This would equate to an additional one million EVs being sold in Europe annually, replacing petrol and diesel equivalents.

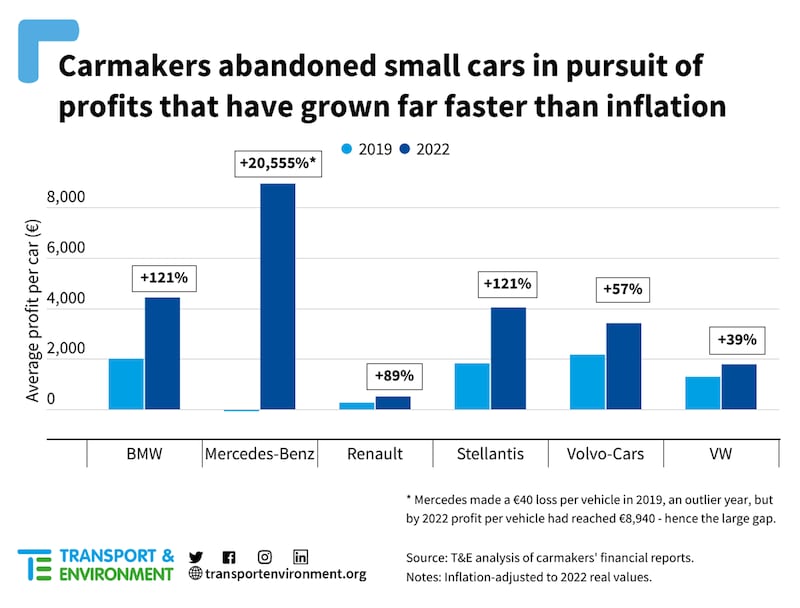

However, the big six European carmakers have abandoned small, affordable cars in pursuit of profits that have grown far faster than inflation, T&E said.

[ Europe is being lapped by China in the electric car raceOpens in new window ]

Between 2019 and last year their net profit per vehicle jumped from between -€40 to €1,920 to €510 to €8,940, adjusted for inflation, the report finds. This was delivered by prioritising sales of larger and more lucrative SUVs which now account for 53 per cent of all vehicles sold in Europe. Electric SUVs, which consume more electricity and raw materials, accounted for 51 per cent of EV sales last year.

T&E said politicians need to create conditions for manufacturers to prioritise small electric cars, which are better for the environment, low-income households and the competitiveness of the European auto industry. It called for a joined-up strategy of EV efficiency rules at EU level; vehicle taxes and subsidies at national level that penalise weight; and higher parking charges for SUVs at local level.

“More car buyers will go electric if small affordable BEVs are available. But right now carmakers are happy to cream the profits off large SUVs which are too expensive for many low-income households. Lawmakers need to step in with efficiency standards, taxes, reform of subsidies and other measures that tip the balance in favour of small, affordable electric cars and ordinary people,” Ms Poliscanova added.

T&E calculated net profit per car of BMW, Mercedes, Renault, Stellantis, Volvo and Volkswagen.